Explore this quick guide on how smart traders choose to deal with USDT (Tether) and experience success often with the AngelX Super platform built for making profits.

The Smart Trader’s Checklist for USDT Success

If you are determined to fully flourish in USDT trading, this read is for you. We will take you beyond the basics you probably already know and discuss practical implementation of crypto tips and tricks at large. By emphasizing suitable strategies and maintaining visibility of key concepts and ideas, you may even be able to minimize risk and achieve steady profits.

This short checklist underscores essential steps for traders of all skill levels. Take use of these practical insights to improve your stablecoin investment strategies-

1. Mastering Analysis and Judgements

Keep on top of the things that affect Tether (USDT), including shifts in regulations and market liquidity. You will be more equipped to make trading judgments if you do thorough research on stablecoin dynamics and the connection with fiat currency, particularly with regard to the US Dollar.

Imagine how an announcement of new stablecoin-friendly policies by a major exchange could spark a rise in USDT. If you realize what a simple announcement of this sort can do, it will enable you to predict the changes or the sudden movement every time.

2. Take Charge of Your Emotions

Although trading can be emotionally draining for experienced traders, it’s especially important to keep your emotions under control. Exercise of self-control and calmness of mind to avoid impulsive purchases or frantic selling helps in such cases. When trading a stablecoin like USDT, one must allow the decision-making to be guided by reasoning and the application of healthy strategies rather than emotional response.

Let’s consider that you bought USDT at a price slump, but your FOMO pushes you to sell it when it dips even lower, incurring losses for you. While you could have waited and observed the price comeback, you actually negated your portfolio.

3. Conduct Comprehensive Research

As an investor, you must never settle for insights that are superficial in nature. Indulge in examining in-depth market trends and professional evaluations. When dealing in Tether’s as a stablecoin, ensure you have luxuriated in as much information as possible. You may even hold robust discussions with experts and communities that are genuine.

The more knowledgeable you are, the better judgements you can make about how fiat currency affects cryptocurrency markets. If you are looking for more creative and wise ideas to invest and grow, connect with AngelX Super Team today. Simply fill out the form. It’s free, simple, and quick!

4. Implement Strong Risk Management

When it comes to cryptos and the volatility they bring along, it is inescapable to invest without having well-defined risk management plans. To reduce possible losses, one may opt for stop-loss orders and choose position sizes. It’s crucial to comprehend how stable the USDT is in comparison to conventional fiat money. This comprehension ensures that you have a safety net in place.

For example, in the event that the price falls to $900, your position will immediately be sold if you purchase $1,000 in USDT and put a 10% stop-loss order. You can trade another day and protect your wealth with this method.

5. Be Mindful of Trading Frequency

A common life belief that says anything in life that’s overdone is unhealthy also holds true when trading crypto. Quality over quantity must be any trader’s motto. By avoiding overtrading, you will be able to stay focused on well-timed, strategically planned trades. This approach will help you protect your portfolio funds and also protect you from paying additional trading fees every now and then and spare you from any emotional damage due to losses. This must be kept in mind when trading Tether pegged to the US Dollar.

For instance, if you focus on only 5 well-researched and planned trades instead of executing ten random trades a week that will cost you $2 fee every trade, it can be burdensome. You would be paying a sum of $20 in fees without any assurance of whether those trades would even earn profits.

6. Cultivate Patience

There is no other way for an investor other than to acknowledge that trading is a journey rather than a quick fix. Give your investments enough time to boost as per the market performance by sidetracking your beliefs of gaining instant gratification or quickly profiting from it. If you approach investing in a stablecoin like USDT with patience, you can eventually reap larger benefits.

A fact you must consider- After purchasing USDT, the price stays unchanged for several weeks. Holding onto your USDT could result in profits when market conditions improve rather than selling out of annoyance, highlighting the importance of having a long-term outlook.

7. Create and Hold to Your Trading Strategies

It is essential to have a clearly defined trading plan. Specify your goals, techniques, and entrance and exit locations. Stay in line with your goals by periodically reviewing and modifying your plan, especially in context with Tether’s role as a link between cryptocurrencies and fiat money.

If you have a robust trading technique, it means you would invariably trade only when specific technical indicators reflect better conditions to earn profits. You may avoid mishaps you may create due to emotional decisions by sticking to your defined plans.

8. Diversify Your Portfolio

You have heard ‘Don’t bet everything on one horse’ before, you would clearly understand what it means to hedge your risks. Spread all your investment across multiple assets. Your diversification may also include stablecoin investments, so the risk is totally and wisely balanced, thereby enhancing potential returns. If you have managed to diversify your portfolio well, you can handle any market fluctuations or dire situations with ease.

For illustration, if your portfolio only consists of USDT and there come negative or unfavorable regulations, your investment is liable to suffer the impact. Alternately, if you decide to invest in an assortment of other cryptos, your portfolio would face less adverse affect than in the previous case.

9. Stay Aware of Fees and Costs

The most important point that many traders are conscious of, however, the new onboarders may miss to realize is nudging into the platform-fee details. Ask your expert about the fees you have to pay for the platform or if there are any costs involved otherwise. Discover the most affordable choices as a beginner. Since crypto involves bulk orders, even small fees can stockpile over time and affect your profitability. This can stand true even in the case of trading Tether or any other stablecoin.

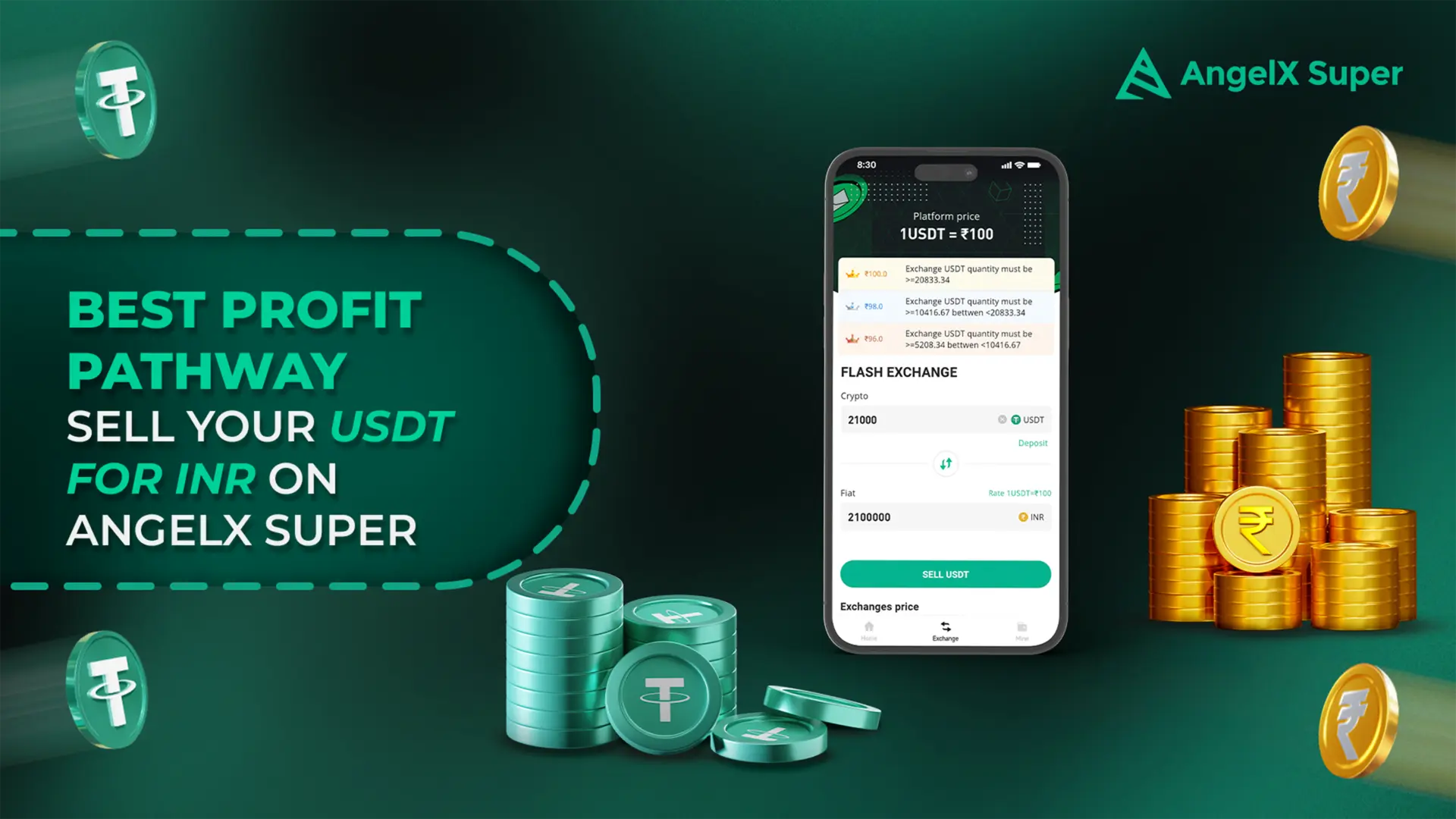

Take the example of you trading frequently and having to pay a 0.3% fee on each trade you make. The 0.15% may accumulate into a bigger amount that you will need to pay from your earned profits. A platform with lower fees means higher profits. Want to pay NO-FEES at all? That’s possible! AngelX Super, a platform that charges no trading fees and hidden costs, is verified by Indian traders.

To close, optimizing profits through USDT (Tether) OTC (Over-The-Counter) trading requires a strategic approach and can become a profitable journey when one sticks to the approach.

AngelX Super can be your prime point when you start to trade since it gives you access to the professionals associated with the industry for several years.

This comprehensive guide with 9 key checkpoints can assist you on how to make the most of your OTC trading endeavors on a platform like AngelX Super. This platform is trader-verified and can totally transform your definition of crypto-trading in today’s emerging world.

FAQ's

Tether, or USDT, is a stablecoin with a US dollar anchor that provides consistent pricing.

Unlike volatile cryptocurrencies, Tether (USDT) is stable, keeping a 1:1 value with the US dollar.

By bridging fiat money and cryptocurrency, USDT permits simple transfers while maintaining stability.

Yes, the value of Tether (USDT) is influenced by the US dollar.

Because USDT is a stablecoin, it lowers volatility and makes cryptocurrency investments safer for every trader.

No, AngelX Super is a fee-free platform for trading. It is designed to maximize profits for traders of all skill-levels.