Explore the answers to 15 most frequently asked questions about Tether USDT about its function in the cryptocurrency space, how to convert USDT to INR, and why AngelX Super proves to be the best option for steady, profitable trading.

15 Most Commonly Asked Questions About Tether USDT

Have you at any point tried to analyze the most recent events happening in the world of cryptocurrencies or stablecoins such as Tether USDT? It is necessary to broaden your horizons regarding this mushrooming industry, whether or not you actively and zealously participate in its investment.

Such close allies with the crypto world enable those who are not active traders to track fresh progressions and developments about finances and technologies that would shape the future of the world.

To obtain knowledge and a fair understanding of the subject matter plays a significant role for any expert trader as much as it does for someone who is still looking forward to trade. Learning about the latest developments and keeping abreast may enhance the trader’s ability to avoid risks, make rational decisions, and seize opportunities in a fast-paced and ever-changing blockchain marketplace.

Say hello to Tether USDT

As one of the most reliable stablecoins available, USDT has grown in popularity by providing stability and smooth conversions between fiat and cryptocurrency.

Yearning to learn more about the power of USDT? We have got you covered.

Let’s unveil and discuss the top 15 most commonly asked questions about Tether USDT. This will help you get a holistic understanding of all the whys, hows, and whos about the stablecoin.

1. What is Tether (USDT)?

Tether (USDT) is known as a star stablecoin of today’s time in terms of market capitalization. It’s a digital currency, introduced by Tether Limited in 2014, and it allows users to reserve and transfer value on the blockchain.

You will find it’s value to be steady, in tandem with the US dollar since the US dollar serves as its foundation. Of all the stablecoins, Tether has the largest volume and has gone to become the most traded asset pair in the crypto market. Cryptocurrency traders may utilize stablecoins, like USDT in cryptocurrency, to move money between their assets and to exchange fiat currency for different cryptocurrencies.

2. How is USDT’s value maintained?

USDT uses its reserves as a means of maintaining its value. There is an equal amount of USD or cash equivalent kept by the corporation for each USDT in circulation. Unlike other cryptocurrencies whose values could vary greatly, this backing guarantees that the value stays stable.

To understand clearly, in order to maintain the 1:1 ratio, Tether as a company must retain $1,000 USDT in reserve in case one makes a purchase worth $1,000.

3. Why do we call USDT a stablecoin?

Since USDT has an association with the US dollar, which is a stable asset, it is known as a stablecoin. The value of USDT is steady, in contrast to other cryptocurrencies that are prone to sharp price fluctuations, enabling traders with a secure place to keep their money during unpredictable markets. The stability of this digital asset can be examined from time to time on any reputable portal, such as Coin Market Cap.

4. Who created Tether?

Three individuals, Craig Sellars, Brock Pierce, and Reeve Collins, each brought a different set of skills to the project when they created Tether in 2014.

When it was first introduced as “Realcoin,” its goal was to bridge the gap between fiat money and digital assets by offering a reliable substitute for the erratic cryptocurrencies of the day.

Realcoin became the first stablecoin to be extensively used in the world when it changed its name to Tether.

In the midst of other digital currencies’ volatility, traders and investors were looking for a solid, dollar-backed asset; thus, this calculated approach helped the project gain traction.

5. Is USDT the same as Tether?

The firm that backs USDT (USD-Tether), a cryptocurrency, is called Tether. Although these terms, USDT and Tether, are frequently used synonymously, they have distinct meanings in reality. The company Tether is in charge of maintaining the networks and reserves that keep the US dollar and bitcoin stable and at a 1:1 exchange rate.

Tether released the USDT stablecoin that is available on several blockchain networks, including Ethereum, TRON, and Binance Smart Chain. It’s commonly called Tether USDT.

Because USDT is frequently referred to as “Tether” in informal conversation, confusion frequently arises. Here’s the distinction that is crucial for everyone to understand-

Tether is the business name that is in charge of upholding regulatory compliance, releasing reserve statistics, and preserving openness for the stablecoin USDT.

Users trade USDT (the token), a digital asset that is used to transfer money between users and across exchanges. One US dollar is represented by one USDT.

Simply put, Tether serves as the foundation for operations, and USDT is the product or currency that traders and investors use.

6. On which blockchains does USDT exist?

There are various blockchain networks where Tether USDT is accessible, such as Ethereum (ERC-20), TRON (TRC-20), and Binance Smart Chain (BEP-20). Users can transfer USDT between platforms with to its multi-chain functionality, which offers flexibility in trading and transactional processes.

7. Is USDT a mineable asset?

USDT functions differently from cryptocurrencies like Bitcoin and Ethereum and is not a mineable asset. Bitcoin and Ethereum depend on Proof-of-Work (PoW) or Proof-of-Stake (PoS) procedures for issuance.

USDT in cryptocurrency uses a whole different model that has no comparison with the conventional mining process used for other cryptos. Conventional mining involves users contributing to the processing power to verify transactions on the blockchain in exchange for freshly minted currency such as Bitcoin.

Tether is a business that pre-issues USDT, a centralized stablecoin, according to the USD reserves it holds. The corporation has an equal amount of US dollars (or cash equivalents) in reserve for each USDT in circulation. In order to maintain a 1:1 peg between the digital currency and the dollar, this implies that new USDT can only be issued when someone deposits US dollars into Tether’s reserves.

8. How secure is it to store value in USDT?

USDT is commonly used by many traders to protect their investments in times of market decline. Unlike the volatility seen with cryptocurrencies like Bitcoin or Ethereum, USDT maintains a stable value since it is pegged to the US dollar. For example, if buoyancy is lost with Bitcoin, moving to USDT will stop making any further inroads into the loss.

9. Is there an exchange or platform where USDT can be purchased?

USDT is available for purchase from the majority of cryptocurrency exchanges, such as Binance, Coinbase, and Kraken. For the Indian audience, directly exchanging USDT to INR becomes a cakewalk on AngelX Super, providing easier access to super profitable trading.

10. In what way can one exchange or sell their USDT for Indian Rupee (INR)?

The conversion of USDT to INR can be done with the help of several platforms. One of the verified and most trusted platforms for the Indian markets is AngelX Super. An easy and rewarding platform designed by crypto experts for intensified trade returns can be explored by all levels of traders. It’s unique provision sets the traders free of not having to bother about the fluctuations of the USDT in INR. They can easily exchange their USDT and gain access to lucrative returns for not just initials but all their transactions.

For instance, in AngelX Super, if you are trading 10,000 USDT, you could get some attractive INR rates based on the volume of the trade.

11. Why makes USDT popular with the traders?

USDT has large market capitalization, high liquidity, and backs up important crypto exchanges. This is what makes this stable digital currency a key player in the trader’s market. When the crypto markets hit bear trends, traders usually sell off their cryptocurrency into USDT, which is like a safe haven. It’s also easy to bet on its major volatility due to the fact that it’s available on the major exchanges.

12. Are there any transfer fees for USDT?

Transfer fees for USDT depend on which blockchain is being utilized for the transaction. For instance, sending USDT over Ethereum network (ERC-20) may attract higher transaction costs than sending over TRON (TRC-20) because of congestion. It’s important that the right network is selected to cut additional costs on transfers. Traders must also verify if the platform has any hidden charges.

13. Is it possible to pay with USDT?

USDT is slowly gaining traction, and some online shops and service providers allow its users to pay in USDT. This is beneficial for sellers and buyers who do not want to deal with the volatile cryptocurrencies that show spiked rates moment to moment. The value of USDT is virtually stable, and that’s considered a boon.

For instance, if you like a product that’s worth 100 USD, this makes your product worth 100 USDT. The cost of the item on purchase is sure to remain unchanged since the value is not going to fluctuate within that short duration when the payment process is ongoing.

14. Which wallets support USDT?

There are many kinds of wallets compatible with USDT, including hardware wallets like ledgers and trezors and software wallets like Trust Wallet and MetaMask. Whichever wallet may be used is determined by the type of blockchain network one predominantly uses, for example, Ethereum or TRON

15. What are the advantages of trading USDT on a platform like AngelX Super?

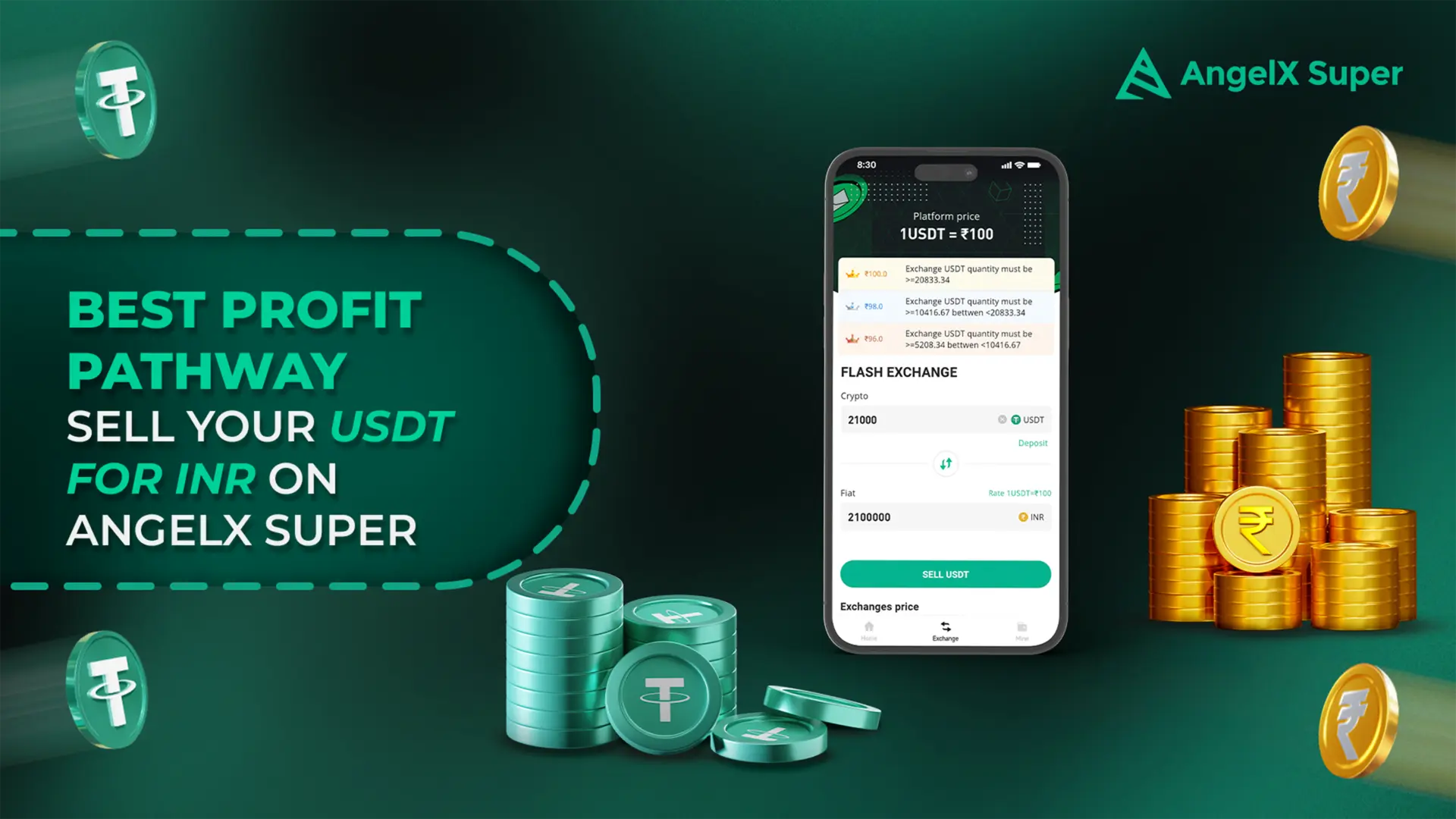

AngelX Super provides the best conversion rates to traders who aim to convert their USDT for INR. Traders benefit from the no-KYC policy and no platform fees. The exchange values for USDT to INR are categorized in three standards for any trader to gain easy profits immediately.

For example:

Trades of 20,833.34 USDT and above can earn INR 100 per USDT.

Mid-level trades between 10,416.67 USDT and 20,833.34 USDT can secure INR 98 per USDT.

Smaller trades of 5,208.34 USDT to 10,416.67 USDT can still earn a solid INR 96 per USDT.

This tiered approach ensures that both large and small traders benefit from competitive rates, making AngelX Super an option that stands out for every trade. Know why exchanging on AngelX Super is a hot deal for all traders.

To conclude, Tether USDT remains a cornerstone of the cryptocurrency world, providing stability and ease of use for traders across the globe. Whether you’re using it to hedge against volatility, transfer funds, or convert to INR on platforms like AngelX Super, USDT is an essential tool for any crypto trader.

By understanding these commonly asked questions, you’ll be well-equipped to make informed decisions about your USDT trades.

FAQ's

Tether USDT is a stablecoin backed by the US dollar and is an appealing choice for investors wishing to lower trading volatility.

USDT acts as a mediator between unstable cryptocurrencies and fiat money, facilitating easy transactions and providing an enduring store of value.

USDT is a stable cryptocurrency as opposed to others like Bitcoin or Ethereum. It's perfect for trading, hedging, or preserving without having to worry about volatile fluctuations.

Trading platforms like AngelX Super provide Indian traders with user-friendly interfaces, competitive rates, no KYC policy, and no fees for conversions of USDT to INR.

Tether USDT has liquidity and flexibility that many other stablecoins might not have because it is widely accepted across numerous blockchains and exchanges.